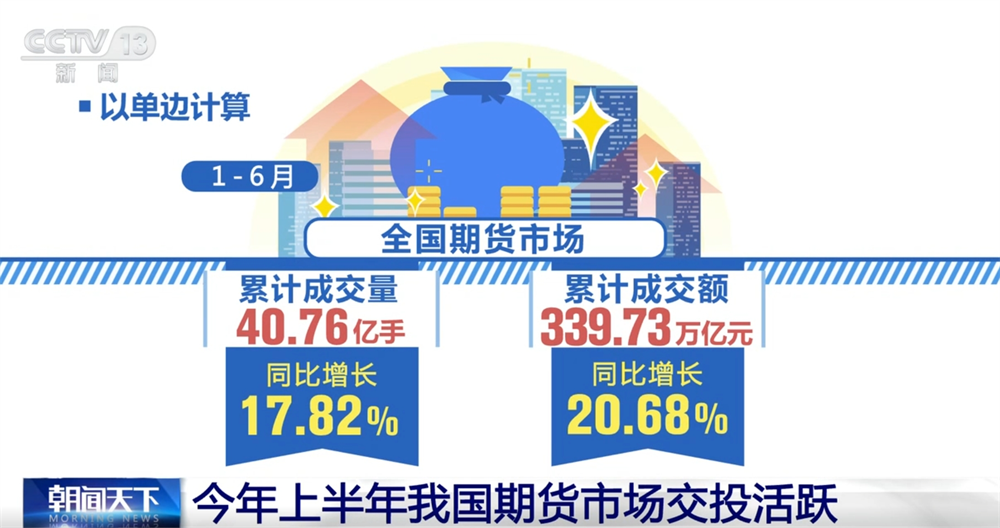

CCTV News: On July 4, data released by the China Futures Association showed that in the first half of this year, my country's futures market trading was active.

Data shows that based on unilateral calculations, the cumulative trading volume of the national futures market from January to June was 4.076 billion lots, with a cumulative trading volume of 339.73 trillion yuan, an increase of 17.82% and 20.68% year-on-year respectively.

In terms of commodities, the precious metals sector continues to lead all commodities, with the agricultural product sector following closely behind.

In terms of finance, in the first half of the year, the cumulative transaction volume of China Financial Futures Exchanges was 112.55 trillion yuan, and the main growth driver came from active trading of 30-year treasury bond futures and CSI 1000 stock index futures. Overall, against the backdrop of the weakening of the US dollar, China's macro liquidity remained positive, providing good support for the stock and bond market. In addition, technology themes continue to be active, driving the popularity of CSI 1000 futures trading.